Average tax withheld from paycheck

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. Simplify Your Day-to-Day With The Best Payroll Services.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

From The State of Oregon.

. Each pay period your employer withholds a part of your wages to cover your income tax bill. Oregons statewide transit tax is one-tenth of one percent 001. Your employer pays an additional 145 the employer part of the Medicare tax.

The employees W-4 form and. For employees withholding is the amount of federal income tax withheld from your paycheck. There is a set percentage however for Social security 62 and Medicare 145 Federal.

A copy of the tax. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The IRS made notable updates to the.

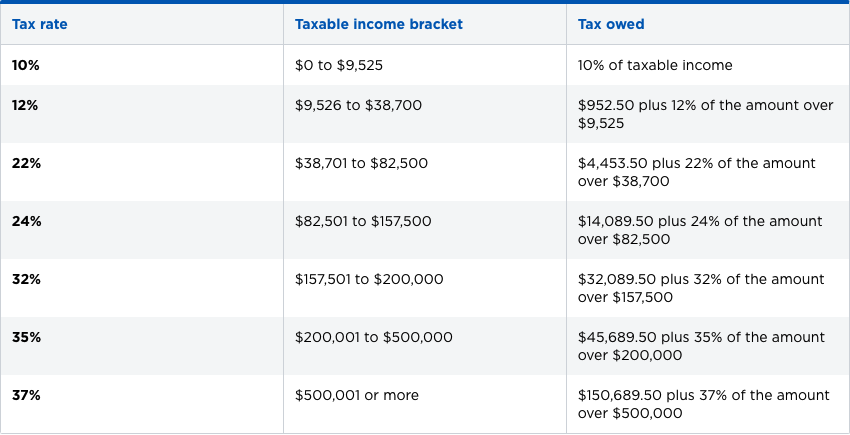

You pay the tax on only the first 147000 of. You find that this amount of 2025 falls in. 300 on income up to 8400.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. The rate jumps to 200 on income above 3100 and up to 5500. Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

The amount of income tax your employer withholds from your regular pay. In addition to this most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

For 2022 employees will pay 62 in Social Security. There are two main methods small businesses can use to calculate federal withholding tax. For a single filer the first 9875 you earn is taxed at 10.

Subtract 1548 from 222491 to arrive at 67691 which is. The amount of federal income taxes withheld will depend on your income level and the withholding information that you put on your Form W-4. Your wages after allowances that exceed 1548 would be subject to a 25-percent tax plus a flat amount of 20105.

Oregon employees will see a new tax withholding on paystubs received after July 1. The employees adjusted gross pay for the pay period. Only the very last 1475 you.

How much tax is deducted from a 1000 paycheck. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability. This year you expect to receive a refund of all.

FICA taxes consist of Social Security and Medicare taxes. The wage bracket method and the percentage method. To calculate Federal Income Tax withholding you will need.

These amounts are paid by both employees and employers. Paycheck Deductions for 1000 Paycheck. 400 up to 11300.

The amount withheld per paycheck is 4150 divided by 26 paychecks or. There is no set percentage of tax withhled for federal income tax withholding. Tacoma and some other metro areas are significantly higher than.

Lawmakers have considered introducing a state income tax in recent years but no attempt has been successful thus far. The amount of taxes that your employer withholds depends on your filing status the amount of. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax.

The first 3100 you earn in taxable income is taxed at 100. See where that hard-earned money goes - Federal Income Tax Social Security. The remaining amount is 68076.

1

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

1

Which Is Better Time Deposit Or Mutual Fund Finance Investing Mutuals Funds Finances Money

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

2022 Income Tax Withholding Tables Changes Examples

1

2022 Federal State Payroll Tax Rates For Employers

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Federal Payroll Tax Rates Abacus Payroll

1

W 2 Irs 2016 Form Irs Forms Irs Periodic Table

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Federal Income Tax Brackets Brilliant Tax